Get the free payroll deduction template

Show details

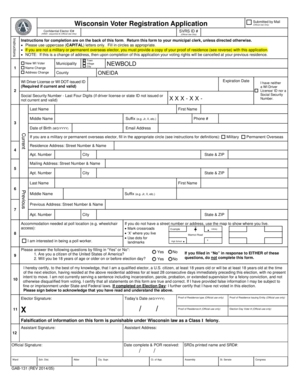

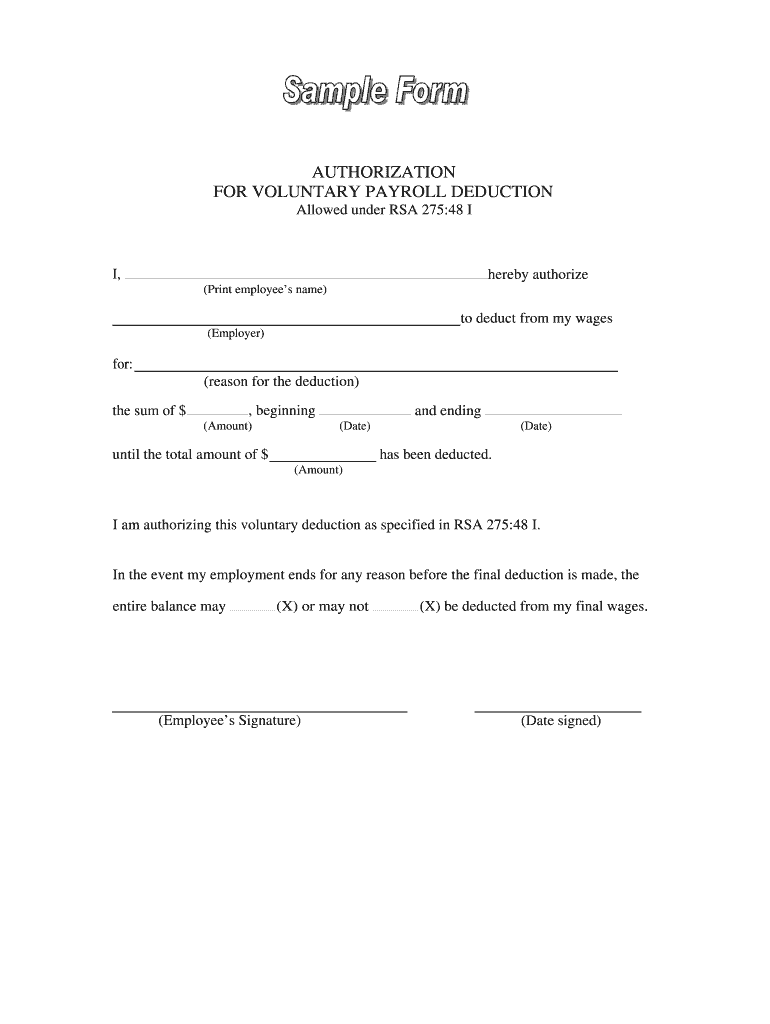

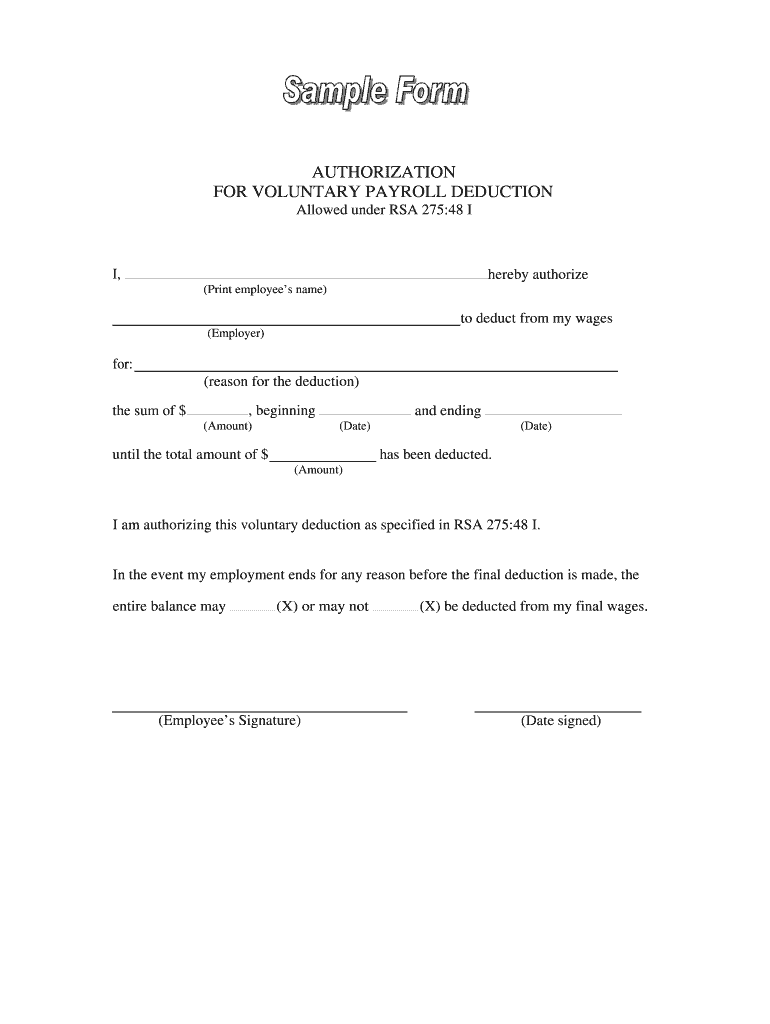

AUTHORIZATION

FOR VOLUNTARY PAYROLL DEDUCTION

Allowed under RSA 275:48 II, hereby authorize

(Print employees name)to deduct from my wages

(Employer)for:

(reason for the deduction), beginning the sum

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign payroll deduction form

Edit your payroll deduction authorization form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee deduction form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary deduction wages online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit authorization voluntary payroll deduction form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deduction form template

How to fill out Authorization for Voluntary Payroll Deduction

01

Obtain the Authorization for Voluntary Payroll Deduction form from your HR department or employee portal.

02

Fill in your personal information at the top of the form, including your name, employee ID, and department.

03

Indicate the specific amount you wish to have deducted from each paycheck.

04

Specify the purpose of the deduction, such as contributions to a retirement plan, charity, or other voluntary programs.

05

Review the terms and conditions outlined on the form, ensuring you understand your commitment.

06

Sign and date the form to authorize the deduction.

07

Submit the completed form to your HR department for processing.

Who needs Authorization for Voluntary Payroll Deduction?

01

Employees who wish to have a portion of their paycheck voluntarily deducted for savings plans, charitable contributions, or other specific financial commitments.

Fill

deduction authorization employment

: Try Risk Free

What is deduct authorization?

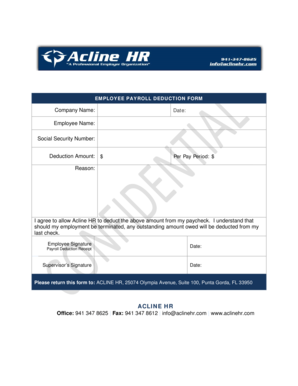

3. + New List. Payroll Deduction Authorization Form means the form or other document designated by the Company as the required evidence of an Employee's election to make voluntary cash contributions through an automatic payroll deduction mechanism.

People Also Ask about payroll deduction forms for employees

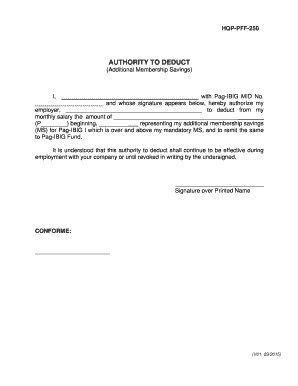

What is authority to deduct for?

Authority to Deduct means the confirmatory authorisation provided by the Employee in the agreement between the employee and the Bank, authorising the Employer to make deductions from the employee's salary or wage.

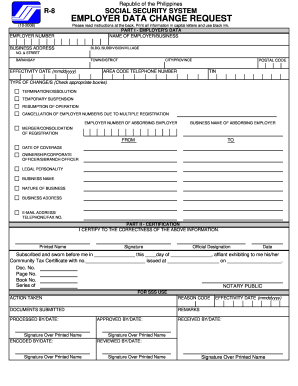

How can I get SSS authority to deduct form?

How to edit authority to deduct form sss online Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one. Simply add a document. Edit sss authority to deduct form. Get your file.

How can I pay my SSS past due loan through employer?

Alternatively, they may also opt to pay through installment. Those who availed the installment scheme should pay a downpayment equivalent to at least 10% of the consolidated loan within 30 calendar days after receiving the approval notice. The remaining balance can be paid in up to 60 months, depending on the amount.

When can I deduct SSS contributions?

Your SSS membership will determine when you need to remit your contributions. If you're a regular employer, payments are due on the last day of the next month. And if you're self-employed, you must pay on the last day of the following month or quarter.

What will happen to SSS loan if I resign?

The employer shall deduct the total balance of the loan from any benefit/s due to the employee and shall remit the same in full to SSS, in case the member-borrower is separated voluntarily (e.g., retirement or resignation) or involuntarily (e.g., termination of employment or cessation of operations of the company).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send authority to deduct for eSignature?

When your deduct form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out payroll deduction form printable using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign authorization payroll deduction form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete voluntary payroll deduction form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your salary deduction form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

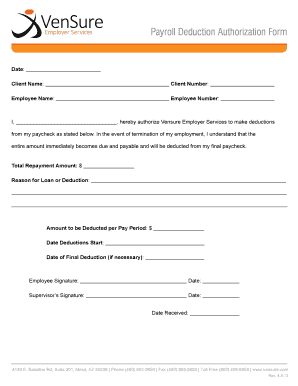

What is Authorization for Voluntary Payroll Deduction?

Authorization for Voluntary Payroll Deduction is a document allowing employees to authorize their employer to deduct certain amounts from their paycheck for specified purposes, such as union dues or charitable contributions.

Who is required to file Authorization for Voluntary Payroll Deduction?

Employees who wish to have certain amounts deducted from their wages for specific purposes, such as union fees or donations, are required to file the Authorization for Voluntary Payroll Deduction.

How to fill out Authorization for Voluntary Payroll Deduction?

To fill out the Authorization for Voluntary Payroll Deduction, employees must provide their personal information, the amount to be deducted, the purpose of the deduction, and their signature to authorize the deductions.

What is the purpose of Authorization for Voluntary Payroll Deduction?

The purpose of Authorization for Voluntary Payroll Deduction is to facilitate voluntary deductions from an employee's paycheck for specified fees or contributions, ensuring that the process is clear and agreed upon by the employee.

What information must be reported on Authorization for Voluntary Payroll Deduction?

The information that must be reported on the Authorization for Voluntary Payroll Deduction includes the employee's name, employee ID, amount to be deducted, frequency of the deduction, purpose of the deduction, and the employee's signature.

Fill out your Authorization for Voluntary Payroll Deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization Deduction Authorize is not the form you're looking for?Search for another form here.

Keywords relevant to voluntary deduction form

Related to payroll deduction form fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.