Authorization for Voluntary Payroll Deduction free printable template

Fill out, sign, and share forms from a single PDF platform

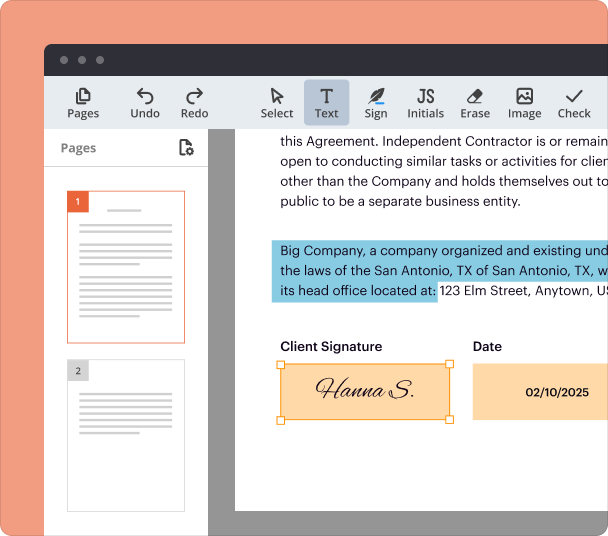

Edit and sign in one place

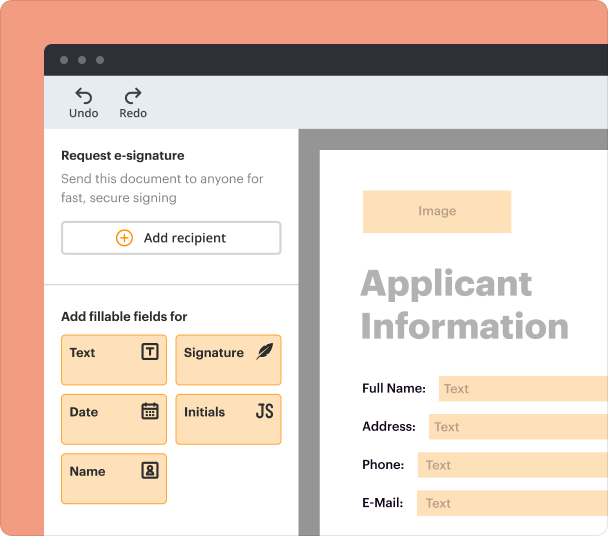

Create professional forms

Simplify data collection

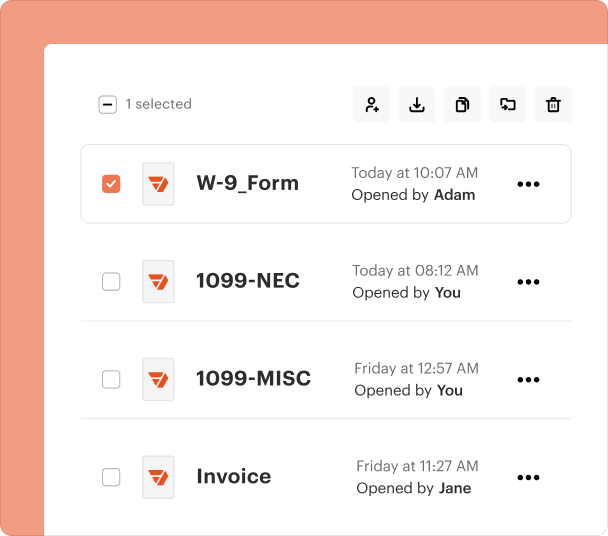

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

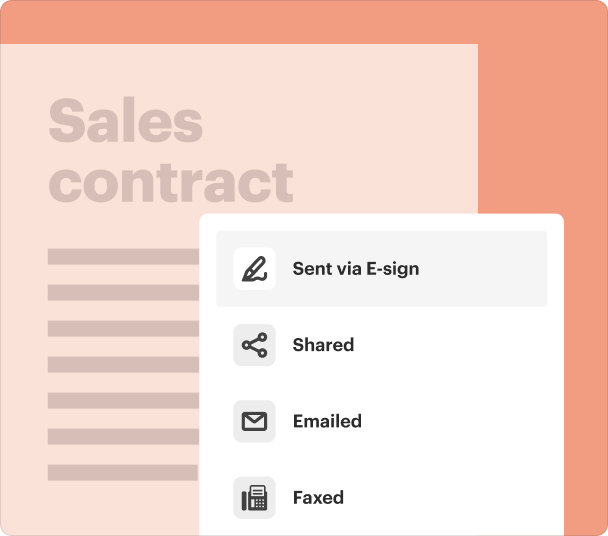

End-to-end document management

Accessible from anywhere

Secure and compliant

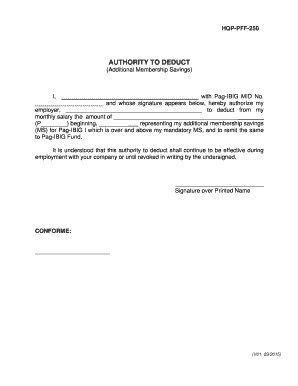

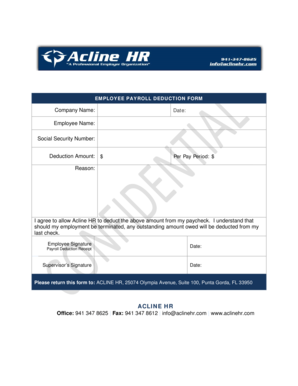

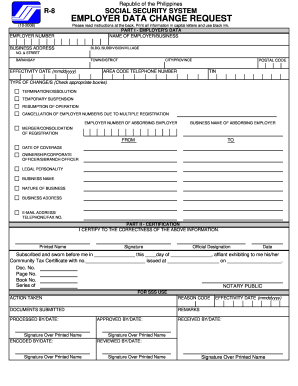

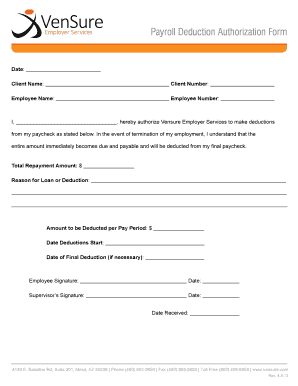

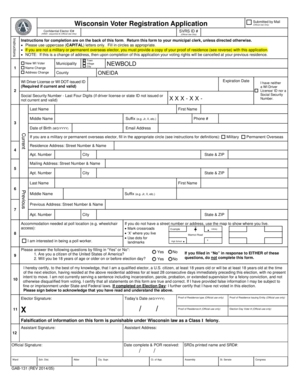

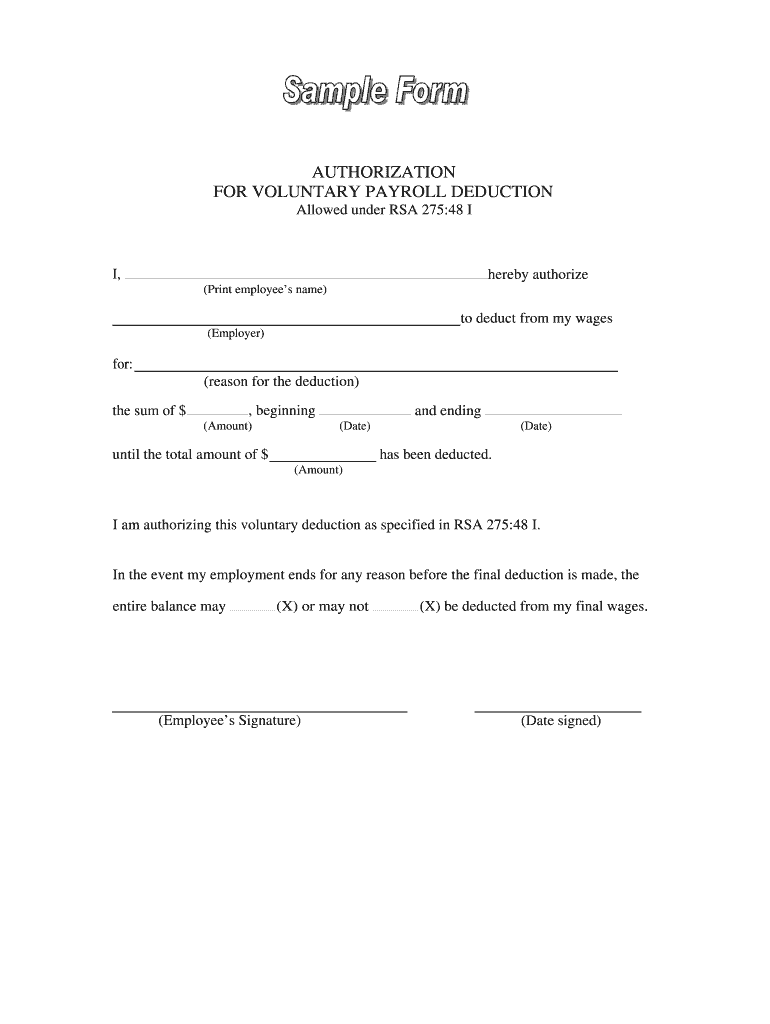

Understanding the Authorization for Voluntary Payroll Form

Definition of the authorization for voluntary payroll form

The authorization for voluntary payroll form is a document that allows employees to permit their employers to deduct specific amounts from their wages. This deduction may be for various purposes, such as contributions to retirement plans, insurance premiums, or other planned disbursements. The form functions as a mutual agreement between the employee and the employer, ensuring transparency and compliance with relevant regulations.

Key Features of the authorization for voluntary payroll form

This form typically includes critical information such as the employee’s name, the employer’s name, the reason for the deduction, the amount to be deducted, and the duration for which the deduction will occur. Additionally, it requires the employee's signature, indicating their consent to the arrangements. The clarity of these features ensures minimal confusion and legal compliance.

When to Use the authorization for voluntary payroll form

Employees should use this form whenever they choose to have specific deductions made from their paycheck voluntarily. Common situations include funding health savings accounts, making contributions to retirement savings plans, or paying for insurance premiums. Using the form provides a formal written record of the agreement and helps clarify the employee's intentions.

Eligibility Criteria for the authorization for voluntary payroll form

Generally, any employee eligible for payroll deductions can fill out this form, provided that their employer offers such options. Employees should ensure they meet any specific criteria set forth by their employers, including participation in relevant programs or specific employment statuses. Each employer may have their own guidelines regarding the approval process.

How to Fill the authorization for voluntary payroll form

Filling out the authorization for voluntary payroll form requires care and accuracy. Employees must provide their full name, the name of their employer, the exact reason for the deduction, the amount to be deducted, and the start and end dates. It is important to read the form carefully to ensure all information is correct and complete before signing and submitting to the employer.

Best Practices for Accurate Completion

To ensure accuracy when completing this form, employees should verify all numerical amounts and dates. They should also review the deductions to confirm they align with their understanding of what is being authorized. Keeping a copy of the completed form can serve as a reference for future discussions with HR or payroll.

Frequently Asked Questions about payroll deduction form

What types of deductions can be authorized?

Employees can authorize various deductions, including retirement contributions, insurance premiums, and union dues, based on their individual circumstances and employer policies.

Can I cancel my authorization after submitting the form?

Yes, you can usually cancel your authorization at any time, but it's important to follow your employer's procedures for doing so. Typically, you'll need to submit a written request to HR.

pdfFiller scores top ratings on review platforms