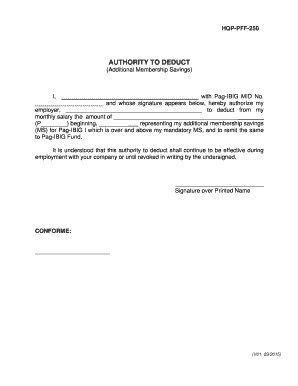

Get the free authority to deduct form

Show details

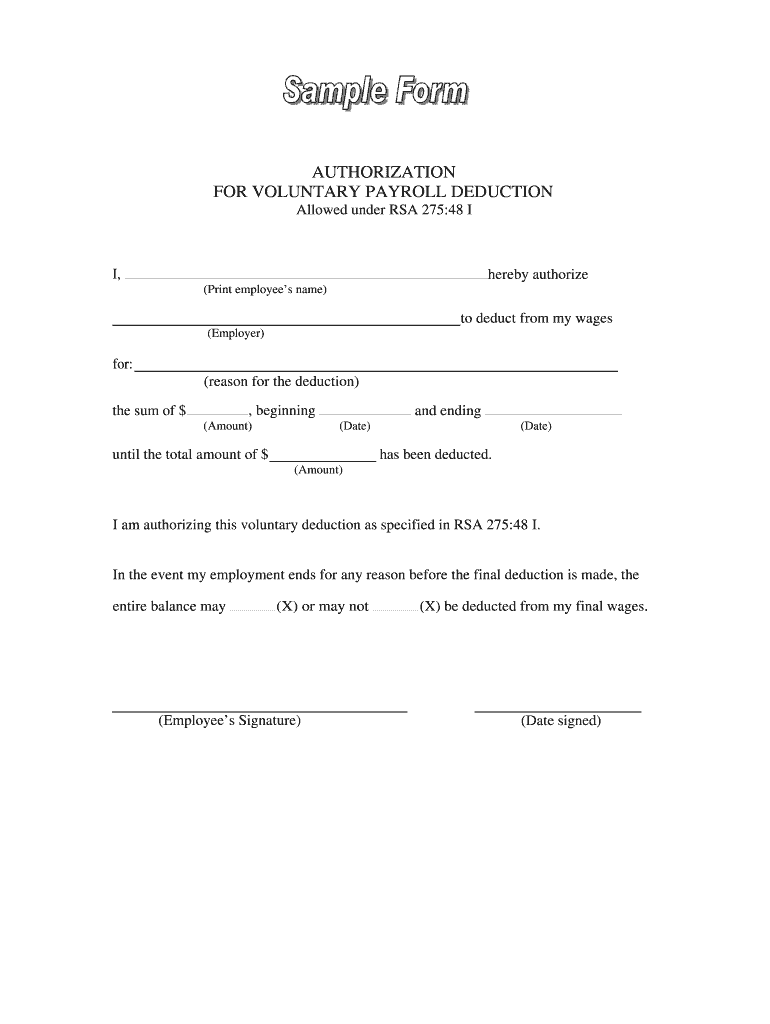

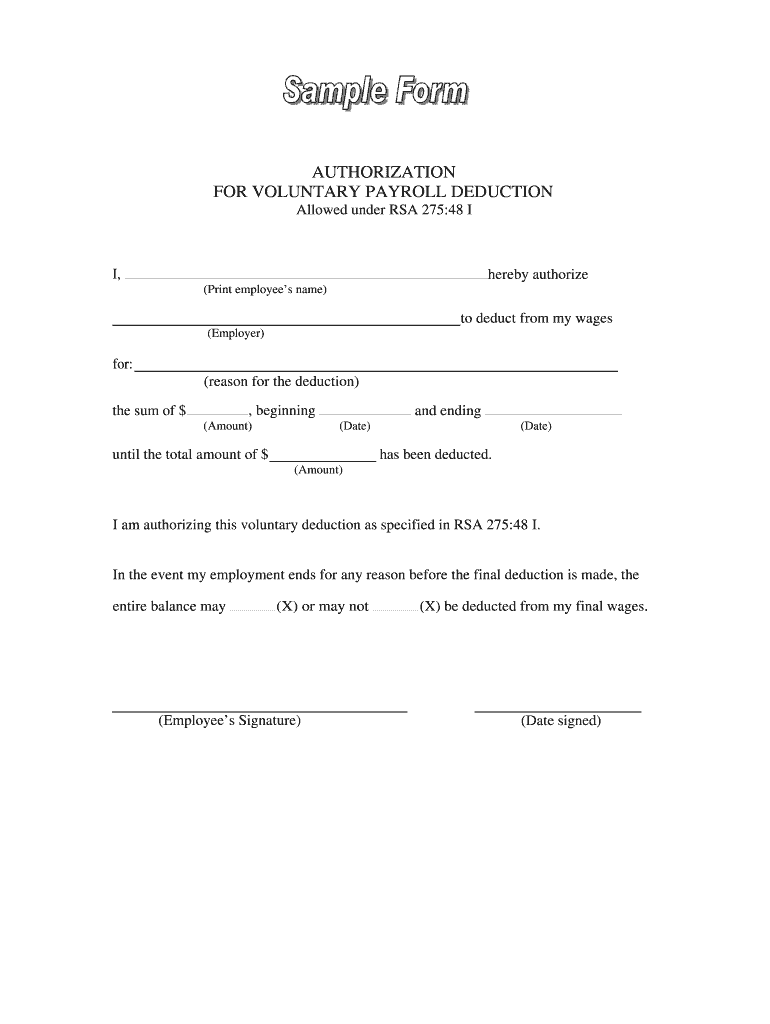

AUTHORIZATION

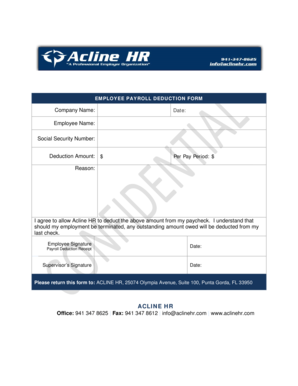

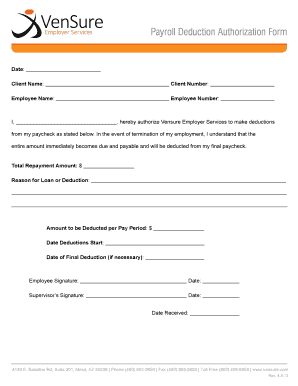

FOR VOLUNTARY PAYROLL DEDUCTION

Allowed under RSA 275:48 II, hereby authorize

(Print employees name)to deduct from my wages

(Employer)for:

(reason for the deduction), beginning the sum

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your authority to deduct form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authority to deduct form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing authority to deduct online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit authority to deduct template form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out authority to deduct form

To fill out the authority to deduct form, follow these steps:

01

Begin by gathering all necessary information and documents, such as your personal identification details, tax identification number, and relevant financial records.

02

Fill in the required personal details accurately, including your full name, address, and contact information. Make sure to double-check for any errors or omissions.

03

Specify the type of authority to deduct you are seeking, whether it is for tax purposes, loan repayments, or any other relevant purpose. Provide a clear and concise explanation or description for the authority you are requesting.

04

If applicable, include any supporting documentation or evidence that may be required to support your request for authority to deduct. This may include copies of contracts, agreements, or any other relevant documents.

05

Review the completed form thoroughly to ensure all sections and details have been filled out accurately and completely. Make any necessary revisions or corrections before submission.

06

Obtain any required signatures on the form, whether it is your own signature or that of a relevant authority or representative.

07

Submit the completed authority to deduct form to the appropriate recipient or organization as instructed. It may be necessary to provide additional copies or documentation, so be sure to carefully follow any submission instructions.

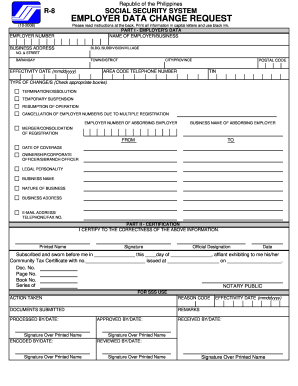

Who needs authority to deduct form?

Individuals or entities who need to authorize another party to deduct funds from their accounts or perform deductions on their behalf may require the authority to deduct form. Specific scenarios could include employers authorizing payroll deductions, individuals authorizing loan repayments, or taxpayers authorizing the deduction of taxes owed, among others. The need for the authority to deduct form may vary based on the specific requirements of different organizations or institutions.

Fill atd form sss : Try Risk Free

What is deduct authorization?

3. + New List. Payroll Deduction Authorization Form means the form or other document designated by the Company as the required evidence of an Employee's election to make voluntary cash contributions through an automatic payroll deduction mechanism.

People Also Ask about authority to deduct

What is authority to deduct for?

How can I get SSS authority to deduct form?

How can I pay my SSS past due loan through employer?

When can I deduct SSS contributions?

What will happen to SSS loan if I resign?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

When is the deadline to file authority to deduct form in 2023?

The deadline to file authority to deduct form in 2023 may vary depending on the state or organization. Generally, the deadline for filing authority to deduct form is the same as the deadline for filing taxes. In the United States, the deadline for filing taxes in 2023 is April 15, 2023.

How can I send authority to deduct for eSignature?

When your authority to deduct template form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out authority to deduct form sss using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign authority to deduct form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete sss authority to deduct form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your authority to deduct sample form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your authority to deduct form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authority To Deduct Form Sss is not the form you're looking for?Search for another form here.

Keywords relevant to authority to deduct template philippines form

Related to authority to deduct from salary

If you believe that this page should be taken down, please follow our DMCA take down process

here

.